Low income bad credit first time home buyer

Many of these programs have. Most lenders look at back-end DTI ratio.

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2022 Badcredit Org

Its Section 502 Guaranteed Loan Program works with approved lenders to finance rural primary dwellings.

. Network of dealer partners has closed 1 billion in bad credit auto loans. First mortgages pay for the purchase of a home whereas home equity loans or second mortgages let you cash out some of the equity youve built since you bought your home. Both are available to first-time home buyers and repeat buyers alike.

How To Get Inflation Relief Payments in 2022. Both the Credit for Low Income Individuals and the Virginia Earned Income Tax Credit cannot exceed the total amount of your tax. Aaron Crowe 81319.

How Do Bad Credit Loans With Guaranteed Approval Work. 2022 Car Loans for Low-Income Earners. These low credit score mortgage lenders specialize in serving borrowers with credit challenges.

Bad credit applicants must have 1500month income to qualify. In either case the key is to limit your initial investment with a low down payment and keep renovation costs low. An all-time low for rates Until recently 2016 held the lowest annual mortgage rate on record going back to 1971.

Specializes in bad credit no credit bankruptcy and repossession. In fact according to FHAs. 2022 Income Limit for 1-4 Person Household.

FHA home loans require lower minimum credit scores and down payments than many conventional loans which makes them especially popular with first-time homebuyers. The best home loan option for you if you have bad credit depends on. VA loans a.

Each lender decided based on a variety of factors for each veteran. First-time home buyers can get financial assistance and access to. Plenty of home loan programs cater to first-time buyers.

A home loan with bad credit is possible even if youre a first-time home buyer. Average credit scores range from 580 to 669. First-time home buyer First-time home buyer loan requirements.

Improving your credit score can take time but here are important steps you can take to get there as soon as. MoneyMutual is a lender-matching service that can arrange for seniors to get personal loans of up to 2500. The best business credit cards offer enticing rates and perks.

In business since 1999. They are designed for people with bad credit or low income. If youre a first-time home buyer.

USDA loans 100 financing. Good credit scores begin at 670. However the minimum credit score required to qualify for a conventional mortgage loan is usually a 620 or better.

Can I Raise My Credit Score by 100 Points. This is good for first-time home buyers because FHA loans allow for a low down payment of just 35 which can help a household with good income but less-than-optimal savings move from renting. This is less than the average Social Security monthly benefit in 2019 of 1471 meaning most recipients will have enough income to prequalify for a loan arranged by MoneyMutual.

Many first-time home buyer loans have a home buyer education requirement. But they have special eligibility requirements to qualify. A few popular options include.

Specializes in auto loans for bankruptcy bad credit first-time buyer and subprime. Mortgages and home equity loans are available to consumers with bad credit. Lets say you manage to buy a house for 250000 with 20 down or 50000.

By Sabah Karimi Free Money. A refundable Virginia Earned Income Tax Credit will be available. Dealers are motivated to make a deal and find a buyer even if you have bad credit.

Freddie Mac says the typical 2016 mortgage was priced at just 365 percent. You can usually borrow from 100 to 1000 and you are expected to return the funds upon the next paycheck. If you qualify these credits can reduce the amount of tax you owe or increase your refund.

Easy 30-second pre-qualification form. Try these 11 tips to boost your credit score on. A Fannie Mae 97 LTV Standard Mortgage requires one borrower to be a first-time homebuyer.

It also offers its Section 502 Direct Loan Program that provides monthly payment assistance to low-income and very-low-income families thereby increasing their ability to repay the loan. Credit bureau Experian doesnt use the term bad credit but it does consider any score below 580 to be very poor credit. FHA loans allow low income and as little as 35 percent down with a 580 credit score.

2022 Income Limit for 5-8 Person Household. USDA loans for low-income buyers in rural and suburban areas. What are the benefits of being a first-time home buyer.

Requires compensating factors to get approved at a high ratio. Virginians with lower income may qualify for one of several income-based tax credits. There isnt a set minimum requirement for income credit score or down payment to qualify for a conventional loan.

This first-time home buyer guide covers loan programs grants and basic mortgage information to get you started on your journey. To be approved you need a steady monthly income of at least 800. Click here for application terms and details.

How to buy a house with 0 down. FHA loan Insured by the Federal Housing Administration FHA loans allow borrowers to buy a home with a minimum credit score of 580 and as little as 35 percent down or a credit score as low. 11 Ways to Improve Your Credit on a Low Income You can build credit on a low income by paying bills on time opening a secured card and more.

Some lenders call guaranteed personal loans payday loans or short-term loans. Low credit scores must not be the result of recent bad credit. Personal loans - Bad credit loans - Fair credit loans- Car finance - Secured loans - Debt consolidation - Bridge loans- Home improvement loans - Loan calculator - Wedding loans - Holiday loans - Business loans - Instant decision loans - Secured bad credit loans - Bad credit debt consolidation loans - No guarantor loans - 1000 loans - 2000.

Each lender is chosen based on a variety of factors such as credit score income and assets credit history etc.

Pin On First Time Home Buyer Tips

How To Buy A House With Bad Credit Nerdwallet

How To Get A Home Loan With Bad Credit 6 Steps To Take Bob Vila

How To Buy A House With Bad Credit Fico Less Than 600 Debt Com

First Time Home Buyer Tax Credit Ultimate Guide To Getting The Most Money 2022 Show Me The Green

How To Buy Your First Home With Bad Credit Buying Your First Home First Home Buyer Buying First Home

5 Steps To Get A Loan As A First Time Home Buyer With Bad Credit Badcredit Org

How To Get A Home Loan With Bad Credit 6 Steps To Take Bob Vila

How To Buy A House With Bad Credit In 2022 Tips And Tricks

How To Buy A House With Bad Credit In 2022 Tips And Tricks

How To Buy A House With Bad Credit In 2022 Tips And Tricks

Buying A New Car When You Have Bad Credit Edmunds

First Time Home Buyer In Ontario With Low Income Woodstreet Mortgage

How To Buy A House With A Low Income Bankrate

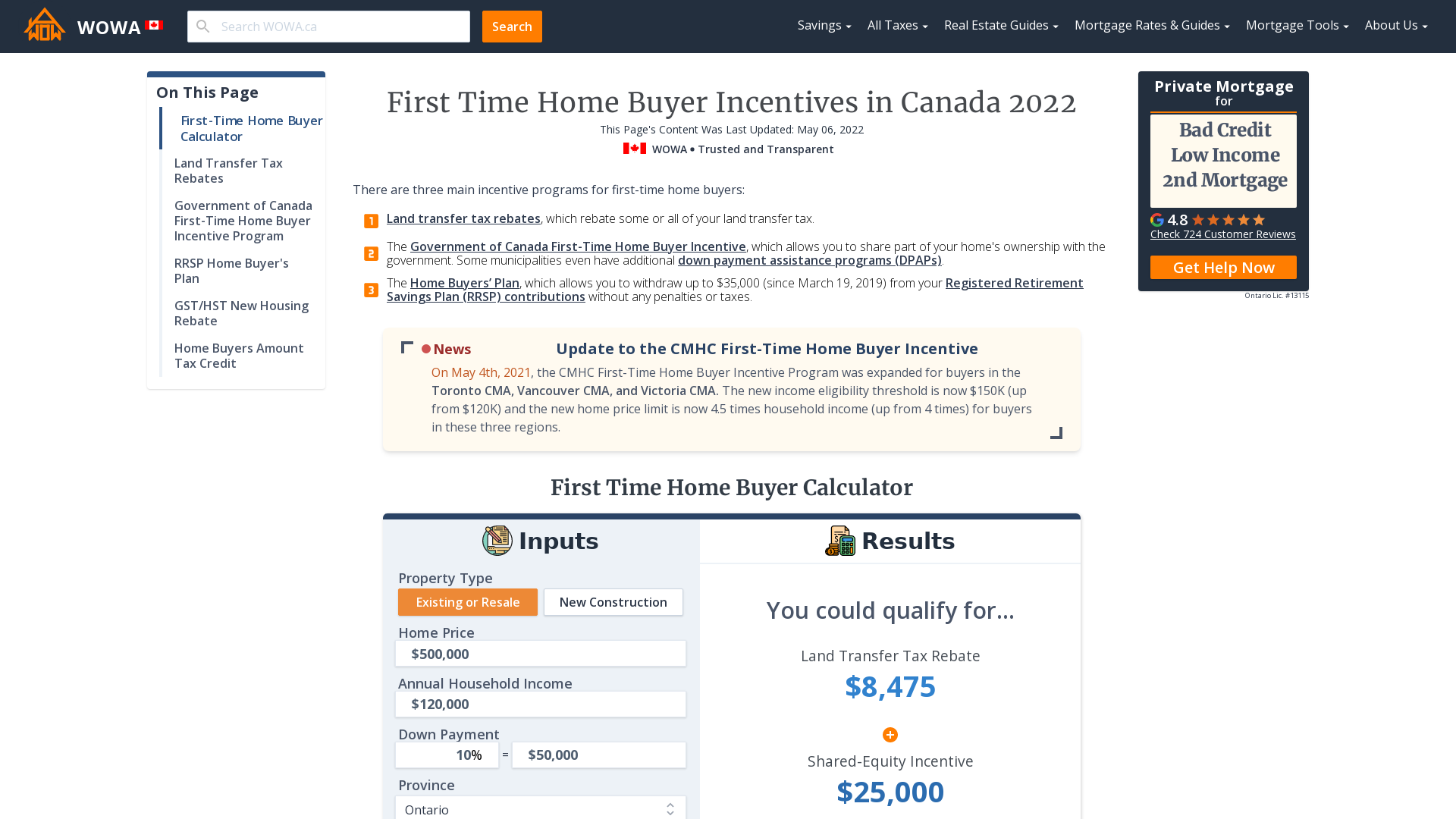

Canada First Time Home Buyers Incentives 2022 Wowa Ca

Poor Credit Mortgage Familylending Ca Inc

How To Buy A House With Bad Credit A Guide For First Time Home Buyers